What Are NFTs?

NFTs, or non-fungible tokens, represent unique digital assets verified using blockchain technology. Unlike cryptocurrencies like Bitcoin and Ethereum, NFTs are indivisible and unique, making each token distinct in value and characteristics. They’re used to verify the ownership and authenticity of digital items, including art, music, and virtual real estate.

In the digital economy, NFTs stand out due to their ability to offer verifiable uniqueness. For example, an NFT can represent a unique piece of digital artwork. This artwork, verified and sold on a blockchain, demonstrates both its authenticity and ownership history.

NFTs utilize blockchain for security and traceability. Blockchain records each transaction, providing an immutable ledger that ensures transparency and credibility. This makes it difficult to counterfeit or tamper with NFTs, adding a layer of trust to digital ownership.

Creators and artists often find value in NFTs as they enable direct sales to buyers without intermediaries. This direct-to-consumer model can increase revenue and reduce costs related to third parties. For example, an artist can sell a unique digital painting directly to a collector, receiving payment without a gallery’s commission.

Additionally, NFTs can include programmable aspects like royalties. When an NFT is resold, the original creator can automatically receive a percentage of the sale, ensuring continued earnings. This feature sets NFTs apart from traditional digital assets, offering ongoing revenue streams for creators.

History Of NFTs

NFTs emerged in 2014, starting with Kevin McCoy’s “Quantum,” a digital artwork. “Quantum” marks the first NFT, setting the stage for other digital artists.

Early projects, like Rare Pepes on the Bitcoin counterparty platform in 2016, showcased the potential of NFTs in collectibles. Rare Pepes, meme-themed digital cards, gained popularity and contributed to the growing NFT community.

2017 saw the launch of CryptoPunks and CryptoKitties, two pivotal projects on the Ethereum blockchain. CryptoPunks, a series of 10,000 unique pixel art characters, highlighted the creativity enabled by NFTs. CryptoKitties, where users breed and trade virtual cats, demonstrated mainstream appeal and brought significant attention to NFTs.

In 2020, NFTs gained further traction with increased interest from artists, musicians, and celebrities. High-profile sales, such as Beeple’s “Everydays: The First 5000 Days,” sold for $69.3 million at Christie’s auction in March 2021, underscored the financial potential of NFTs and fueled public interest.

Prominent NFT marketplaces like OpenSea, Rarible, and Foundation facilitated the buying and selling of NFTs, creating a robust market ecosystem. The evolution of these platforms provided easy access for creators and collectors, amplifying the growth of the NFT space.

NFTs continue to evolve, influencing digital ownership and fostering innovative use cases. Their history reflects the rapid advancements in blockchain technology and the increasing recognition of digital assets in mainstream culture.

How NFTs Work

NFTs operate on blockchain technology, using smart contracts to manage transactions and validate ownership. These key elements drive the unique characteristics that distinguish NFTs from other digital assets.

Blockchain Technology

Blockchain technology underpins NFTs, offering a decentralized ledger for recording transactions. This ledger ensures transparency, security, and immutability. Each NFT is stored on a blockchain like Ethereum, Solana, or Flow.

These blockchains record every transaction, making it impossible to alter ownership records fraudulently. Additionally, the decentralized nature of blockchain prevents single points of failure, enhancing the security and reliability of NFTs.

Smart Contracts

Smart contracts automate processes within NFT transactions. They are self-executing contracts with terms directly written into code. For instance, when an NFT is sold, the smart contract ensures the seller receives payment, and the ownership is transferred to the buyer automatically. Smart contracts also allow creators to embed royalty mechanisms, so they earn a percentage of subsequent sales. This feature supports artists and creators by enabling continuous revenue from their work.

The intricate blend of blockchain and smart contracts forms the foundation of NFTs, making them unique, reliable, and versatile digital assets.

Types Of NFTs

Understanding the various types of NFTs enhances our appreciation of their diverse applications and potential impact. Below are key categories of NFTs.

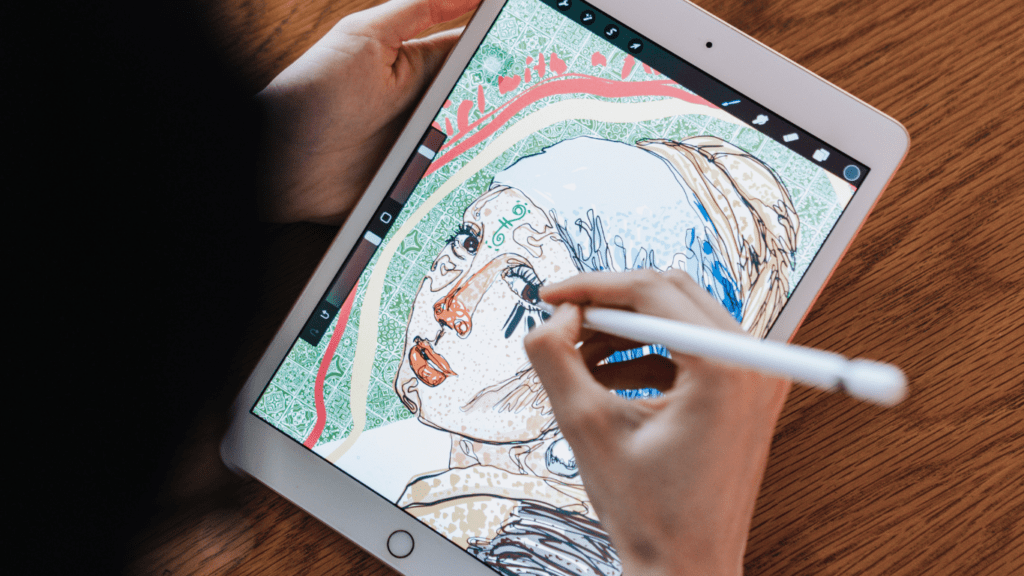

Digital Art

Digital art NFTs revolutionize how we create and collect art. These unique tokens represent ownership of digital creations like:

- illustrations

- animations

- generative art

Platforms like SuperRare and Foundation specialize in digital art NFTs, offering curated marketplaces for artists and collectors. Notable sales, such as Beeple’s “Everydays: The First 5000 Days” for $69.3 million, underscore the high value placed on these digital pieces. Artists benefit through direct sales, eliminating intermediary fees and securing royalties through smart contracts.

Virtual Real Estate

Virtual real estate NFTs enable ownership of digital land within virtual worlds. Platforms like Decentraland and Cryptovoxels offer users the ability to buy, sell, and build on their virtual parcels. Digital landowners can develop virtual properties, host events, or lease spaces, creating new revenue streams.

The scarcity of virtual land and the growing interest in metaverse experiences drive the value of these NFTs. High-profile transactions, such as the $2.4 million virtual property sale in Decentraland’s Fashion District, highlight their lucrative potential and growing market interest.

Benefits Of NFTs

NFTs provide several advantages in the digital space, offering unique features that drive their popularity and value.

Ownership And Provenance

NFTs ensure verifiable ownership of digital assets. Through blockchain technology, it’s possible to trace the origin and ownership history of an asset, providing clarity that traditional art or collectibles can’t. Blockchain entries can’t be altered, ensuring authenticity. This is crucial for artists and collectors, as it prevents counterfeiting and verifies the legitimacy of digital assets.

Monetization Opportunities

- NFTs open new revenue streams for creators.

- Artists, musicians, and content creators can sell their work directly to fans, eliminating intermediaries.

- Smart contracts can automatically allocate royalties for secondary sales, providing ongoing revenue beyond the initial transaction.

- This is particularly beneficial for artists who often lose track of their work once it’s sold.

- A digital artist can earn a percentage from each resale of their NFT, maintaining financial interest in their work long-term.

Criticisms And Challenges

As NFTs gain prominence, they face several criticisms and challenges that can’t be ignored.

Environmental Impact

NFTs use blockchain technology, particularly Ethereum, which employs a proof-of-work (PoW) consensus mechanism. This mechanism requires significant computational power, leading to high energy consumption.

According to Digiconomist, Ethereum’s annual energy consumption is comparable to that of some countries, generating a sizable carbon footprint. Adopting greener alternatives like proof-of-stake (PoS) remains crucial but isn’t yet widespread.

Market Speculation

The NFT market has been likened to a bubble due to its speculative nature. Prices for digital assets can soar to unsustainable levels. For instance, the sale of Beeple’s artwork for $69.3 million epitomizes this trend. Critics argue that such volatility undermines the long-term value and stability of NFTs as investments. Regulatory scrutiny and potential market corrections could impact future valuations significantly.

Future Of NFTs

The future of NFTs holds promising developments. Given their growing popularity, mainstream adoption looks inevitable. Major industries, including entertainment and real estate, are exploring NFTs for unique applications.

Integration With Metaverse

NFTs will integrate deeply into the metaverse. Virtual worlds will use NFTs for in-game assets, real estate, and digital identities. For example, platforms like Decentraland and The Sandbox already use NFTs to represent virtual land and items, enhancing immersive experiences.

Evolving Standards And Protocols

Evolving standards and protocols will drive NFT innovation. New blockchain technologies that reduce energy consumption and transaction costs are emerging. Ethereum 2.0 aims to transition to a proof-of-stake mechanism, improving efficiency and sustainability.

Regulation And Legal Frameworks

Regulation will shape the NFT landscape. Legal frameworks addressing ownership rights, intellectual property, and taxation will become clearer. Governments and regulatory bodies will establish guidelines to protect buyers and sellers.

Broader Accessibility

Broader accessibility will democratize NFT creation and trading. User-friendly platforms and tools will enable artists and creators without technical expertise to mint and sell NFTs. Lower barriers to entry will foster a more diverse and inclusive NFT ecosystem.

Increased Interoperability

Increased interoperability will enhance the utility of NFTs. Cross-platform compatibility will allow NFTs to function across different ecosystems. Projects like Polkadot and Cosmos enable NFTs to move between various blockchains, boosting their versatility.

Enhanced Security And Authentication

Enhanced security measures will protect NFT transactions. Blockchain advancements and improved cryptographic methods will safeguard assets from fraud and theft. Authentication technologies will ensure the legitimacy of NFTs, fostering greater trust.

Financial Innovations

Financial innovations will emerge around NFTs. Fractional ownership and NFT-based lending will create new financial models. Platforms like Uniswap already explore NFT collateralization, broadening financial opportunities.

Environmental Solutions

Environmental solutions will mitigate the ecological impact of NFTs. Research into greener technologies and the adoption of eco-friendly blockchains will reduce carbon footprints. Efforts like regenerative finance (ReFi) aim to align blockchain practices with environmental sustainability.

By anticipating these trends, I see the NFT ecosystem evolving into a robust and versatile market, influencing various sectors and offering new opportunities.

Chief Technology Officer (CTO)

As Chief Technology Officer, Victor Kenneyell oversees the technical infrastructure and development strategies of the website. With a background in computer science and blockchain engineering, Victor ensures that the platform remains at the forefront of technological advancements in the crypto industry. His expertise in smart contracts, cybersecurity, and blockchain scalability solutions helps the website provide users with a secure and innovative experience.

Chief Technology Officer (CTO)

As Chief Technology Officer, Victor Kenneyell oversees the technical infrastructure and development strategies of the website. With a background in computer science and blockchain engineering, Victor ensures that the platform remains at the forefront of technological advancements in the crypto industry. His expertise in smart contracts, cybersecurity, and blockchain scalability solutions helps the website provide users with a secure and innovative experience.