Why These Terms Matter Right Now

Blockchain isn’t just about Bitcoin anymore. It’s planted roots in industries like healthcare, supply chain, real estate, and logistics places you wouldn’t expect. It’s being used to verify identities, trace food sources, and manage digital ownership. Problem is, the tech moves fast, and the jargon can feel like a wall.

That’s where knowing the basics comes in. If you can’t follow the conversation, you either get left behind or make bad calls based on hype. Terms like “smart contract” and “node” don’t just sound clever they hint at why blockchain tech is gaining real traction.

Clear language is your shortcut through the noise. No buzzwords, no tech gatekeeping. Just the essentials, so you can make sense of the space, ask sharper questions, and spot what actually matters behind the next big headline.

Blockchain

At its core, a blockchain is just a digital ledger one that doesn’t live on a single server but gets distributed across a network of computers, or “nodes.” Every time data gets added (a transaction, a file update, whatever), it’s verified by the network, locked into a block, and chained to the one before it. That linked structure makes it incredibly hard to mess with without everyone noticing.

Two things make this tech especially powerful: immutability and transparency. Once a block of data is confirmed, it’s basically set in stone. No edits, no erasures. That’s immutability. And because everyone on the network can access the same record, there’s no one gatekeeping the truth. That’s transparency and it builds trust without needing a middleman.

Sure, it’s the tech behind crypto like Bitcoin and Ethereum, but blockchain’s moving way beyond that. It’s already being used in supply chains, healthcare records, real estate deals, and more. Wherever you need a secure, tamper proof record, blockchain’s becoming the go to backbone.

Decentralization

At its core, decentralization is about breaking up control. Instead of a single company or authority holding all the power over a system, control is spread out across a network. For blockchain, that means no one person or organization can tweak records, freeze transactions, or disappear with your data. It’s not just a tech gimmick it’s a design choice aimed at trust, transparency, and resilience.

This shift matters. When power isn’t concentrated, it’s harder for bad actors to manipulate things. That boosts privacy and security by design, not as a bolt on feature. Think fewer data leaks, less censorship, and systems that keep running even if one part fails.

Still, there’s confusion. Some people assume decentralization means leaderless chaos. Not true. Most decentralized systems still use rules (like consensus mechanisms) to stay organized. Others think just using blockchain makes a project decentralized but if all the infrastructure lives on Amazon servers and one team runs the show, it’s not exactly distributed.

Bottom line: decentralization puts users back in control. It isn’t perfect, but it’s a step away from the gatekeepers who’ve run and often ruined digital platforms for decades.

Node

Think of a node as a computer that plays by blockchain rules. It stores a full or partial copy of the blockchain and participates in maintaining the network. Not all nodes do the same job, though.

A full node keeps the entire blockchain history every block, every transaction. It independently verifies all activity and helps enforce the rules of the network. When you hear about Bitcoin or Ethereum being decentralized, full nodes are the backbone making that happen.

Light nodes, on the other hand, don’t carry the full weight. They store only the most essential parts of the blockchain, usually just the headers. They’re faster and less resource intensive, often used in mobile wallets or other lightweight apps. Light nodes still verify transactions but rely on full nodes for the heavy lifting.

So why does this matter? Together, nodes help keep everyone honest. They check each other’s work. If someone tries to sneak in bad data or rewrite history, they get overruled by the majority. No central authority, no trust needed just code and consensus. That’s how nodes protect the integrity of the system.

Smart Contract

A smart contract is code that runs itself once specific conditions are met. No lawyers, no managers, no middlemen just programmed logic on the blockchain. Think of it as a vending machine: you put in the right input, like a token or command, and the system does what it’s told without outside help.

This tech is a big deal because it automates trust. Smart contracts make sure things happen as promised. Want insurance that pays out instantly after a storm? Build it into a smart contract. Want to sell an NFT and have royalties automatically split between collaborators? Also doable.

They’re especially powerful in decentralized spaces like DAOs (Decentralized Autonomous Organizations), where code enforces the rules of group operations. It’s all about cutting friction less back and forth, less human error, more speed.

But don’t mistake “automatic” for simple. A smart contract only works as well as the code it’s built on, so clarity and precision matter a lot. Bugs aren’t just annoying they can be irreversible. That’s why testing and audits are essential, even in this trustless system.

Consensus Mechanism

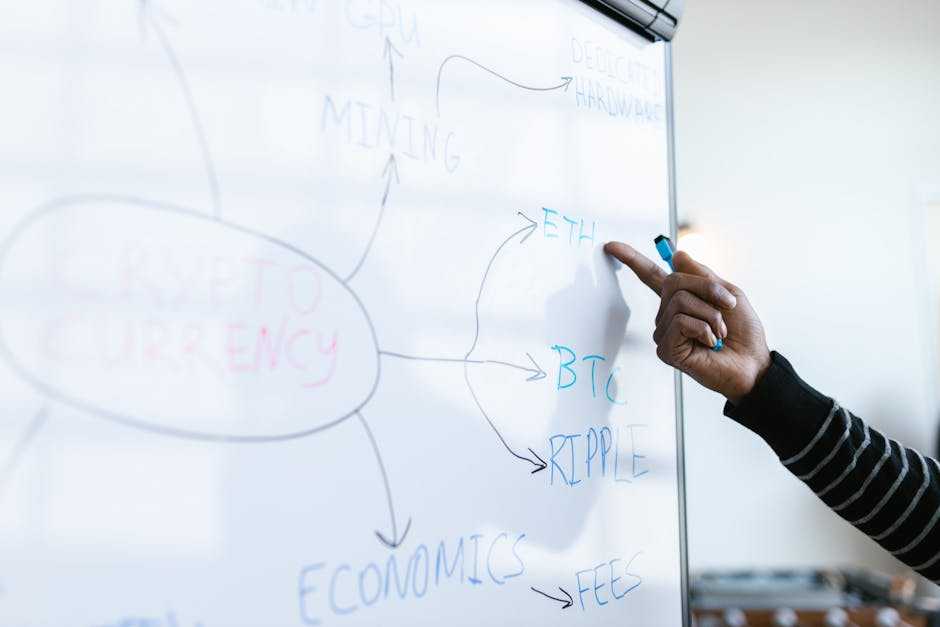

Blockchains don’t run on trust they run on math and systems that force agreement. These systems are called consensus mechanisms. They’re what let a decentralized network agree on the same version of truth, even when anyone can join.

The two most talked about methods? Proof of Work (PoW) and Proof of Stake (PoS).

In Proof of Work, like what powers Bitcoin, miners use raw computing power to solve complex math problems. It’s secure, but energy hungry. Proof of Stake, on the other hand, skips the mining war. Instead, validators lock up some of their tokens (their “stake”) for the right to confirm new data. Less electricity, faster process.

These days, PoS is winning ground. Ethereum the second biggest blockchain switched from PoW to PoS in 2022. It’s more eco friendly and scales better. That said, PoW still holds value for networks prioritizing security and simplicity over speed.

Different chains use different systems, but whichever direction they take, consensus is the backbone. It’s how trust gets coded into the network.

Token

In the blockchain world, a token is a digital asset. That asset might represent something useful in the real world like loyalty points, voting power, or even shares in a project or it could live entirely in the digital realm. Either way, tokens function as units of value or utility inside a blockchain based system.

There are three major types you’ll hear about:

- Utility tokens give access to a product or service. Think of them like digital coupons or credits. You can use them within specific platforms, but they usually don’t represent any ownership.

- Security tokens are more like traditional investments. They’re tied to real world assets or profits and often come with regulations because they represent ownership stakes.

- Governance tokens offer voting power. Holders of these tokens can help steer the direction of a platform or protocol, like deciding on upgrades or funding priorities.

Here’s the kicker: not all tokens are cryptocurrencies. Crypto like Bitcoin or Ethereum is designed to act like money. Tokens, on the other hand, often serve as tools giving access, influence, or value in a narrow ecosystem. Understanding that distinction clears up a lot of confusion when you’re trying to decode the latest Web3 project.

Wallet

What Is a Wallet in Blockchain?

A blockchain wallet is a tool that allows users to store, send, and receive digital tokens such as cryptocurrencies or other blockchain based assets. While it’s called a “wallet,” it doesn’t actually hold your tokens; instead, it stores the keys that give you access to them on the blockchain network.

Types of Wallets

Understanding the different types of wallets is essential to keeping your assets secure and accessible.

1. Hot Wallets:

Connected to the internet

Easy for everyday transactions

Examples: mobile apps, desktop apps, browser extensions

Convenience comes with increased vulnerability to hacks

2. Cold Wallets:

Offline storage solutions

Used for long term holding and increased security

Examples: hardware wallets, paper wallets

Less convenient but much safer against cyber threats

Why Your Seed Phrase Is Everything

When you create a wallet, you’re given a seed phrase a series of random words that act as your master key. This phrase is all someone needs to gain full access to your funds.

Store it offline and never share it

Losing it means losing access forever no “Forgot Password” option

Some wallets allow a backup method, but the seed phrase remains the single point of recovery for most

Tips for Securing Your Wallet:

Use a reputable wallet provider

Enable two factor authentication if available

Back up your seed phrase in multiple secure locations

Consider using multi signature wallets for added protection

Gas Fees

When you interact with a blockchain whether by transferring a token or executing a smart contract there’s a cost involved. That cost is known as a gas fee.

What Are Gas Fees?

Gas fees are payments made by users to compensate for the computing energy required to process and validate transactions on a blockchain network.

They ensure the network isn’t flooded with spam or junk transactions

The fee acts as an incentive for validators (or miners) to include your transaction in the next block

If the fee is too low, your transaction might be delayed or ignored altogether

Why Fees Vary

Gas fees fluctuate based on supply and demand for block space and network congestion.

Network congestion: When too many users try to transact at once (e.g., during a popular NFT mint), fees spike

Blockchain type: Ethereum tends to have higher gas fees than newer Layer 2 networks like Arbitrum or Optimism

Transaction complexity: A simple token transfer costs less than executing a complicated smart contract

Understanding how these factors interact can help users make smarter and more cost effective decisions.

Smart Ways to Minimize Gas Fees

While gas fees are unavoidable on many blockchain networks, savvy users can take steps to reduce them:

Time transactions during low activity periods, such as weekends or off peak hours

Use Layer 2 solutions (like Polygon or Arbitrum) that offer faster, cheaper transactions

Bundle actions: Some platforms let you group multiple actions in one transaction to save on fees

Being strategic about when and how you interact with the blockchain is key to avoiding excessive costs.

NFT (Non Fungible Token)

NFTs are unique digital assets stored on a blockchain. Unlike cryptocurrencies like Bitcoin, NFTs aren’t interchangeable they’re one of a kind. Think of them as digital proof of ownership, stamped onto something that can’t be copied or altered. Originally popularized by art and collectibles, NFTs have broken through into gaming, virtual real estate, music rights, ticketing, and more.

For vloggers and creators, NFTs offer a new way to connect with audiences. You’re not just selling a product you’re selling access, authenticity, or experience. Imagine releasing limited behind the scenes content, early merch drops, or VIP event passes as NFTs. And because of the way blockchain works, you’ll always know who owns what. That’s provenance chain of custody made public.

Ownership is changing. NFTs may look like a trend, but at their core, they solve a real problem: digital assets haven’t had clear, verifiable ownership until now. Whether you’re minting them or using them, it’s wise to start paying attention.

DAO (Decentralized Autonomous Organization)

DAOs are where blockchain meets community management. At their core, DAOs use code and consensus to make decisions no CEO, no hierarchy, just rules written into smart contracts and votes from token holders. Think of it as a shared bank account with a built in constitution.

These organizations can fund projects, launch ventures, or manage communities all without a traditional leader. Instead, governance is handled through transparent voting, often weighted by how many governance tokens each user holds. Proposals are submitted, debated, and executed by code. The result: less red tape, more collective control.

But ditching the boss isn’t risk free. Without centralized leadership, some DAOs struggle with coordination, unclear accountability, and voter apathy. Smart contract bugs can freeze funds. Power dynamics can still exist if a few wallets hold most of the tokens. On the flip side, when DAOs work, they scale fast, reward participation, and adapt quickly.

For an even deeper vocabulary breakdown, check out our full blockchain terms guide.

Chief Content Strategist & Unique Author

Paulo Okellyansy is the Chief Content Strategist responsible for curating and managing the platform’s editorial direction. With an in-depth knowledge of cryptocurrency markets and digital finance, Paulo crafts engaging, informative content that resonates with both newcomers and seasoned crypto enthusiasts. His ability to simplify complex topics and identify emerging trends has helped position the website as a go-to resource for cryptocurrency insights.

Chief Content Strategist & Unique Author

Paulo Okellyansy is the Chief Content Strategist responsible for curating and managing the platform’s editorial direction. With an in-depth knowledge of cryptocurrency markets and digital finance, Paulo crafts engaging, informative content that resonates with both newcomers and seasoned crypto enthusiasts. His ability to simplify complex topics and identify emerging trends has helped position the website as a go-to resource for cryptocurrency insights.