The Birth of Bitcoin: A New Dawn

In 2008, an unknown individual or group called Satoshi Nakamoto introduced Bitcoin, marking the birth of blockchain technology. This section delves into the origins and early years of Bitcoin, from its enigmatic creator to the first block mined and the subsequent hurdles faced.

The Mysterious Satoshi Nakamoto

Satoshi Nakamoto’s identity remains one of the biggest mysteries in modern technology. Nakamoto published the Bitcoin whitepaper, Bitcoin: A Peer-to-Peer Electronic Cash System, in 2008.

He detailed a revolutionary decentralized digital currency that operated without a central authority. Nakamoto communicated through forums and emails, contributing to the Bitcoin project until 2010.

Since then, Nakamoto has vanished, leaving a legacy that continues to influence the world.

The Genesis Block: Bitcoin’s Inception

The Genesis Block, also known as Block 0, represents the beginning of the Bitcoin blockchain. Mined by Nakamoto on January 3, 2009, this block contained a message referencing a headline from The Times: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This message underscored Bitcoin’s aim: providing an alternative to traditional banking systems. The Genesis Block set the stage for all future Bitcoin transactions.

Early Adoption and Challenges

Bitcoin’s early adoption involved a small community of enthusiasts and developers. In 2010, a programmer named Laszlo Hanyecz made the first known commercial Bitcoin transaction, buying two pizzas for 10,000 BTC.

However, Bitcoin faced numerous challenges, including security concerns and regulatory scrutiny. High-profile hacks, such as the 2011 Mt. Gox breach, highlighted the need for robust security measures. Despite these obstacles, Bitcoin’s resilience paved the way for broader acceptance and growth.

The Evolution of Blockchain Technology

Blockchain technology has evolved significantly since Bitcoin’s inception, expanding into various sectors and applications beyond cryptocurrency.

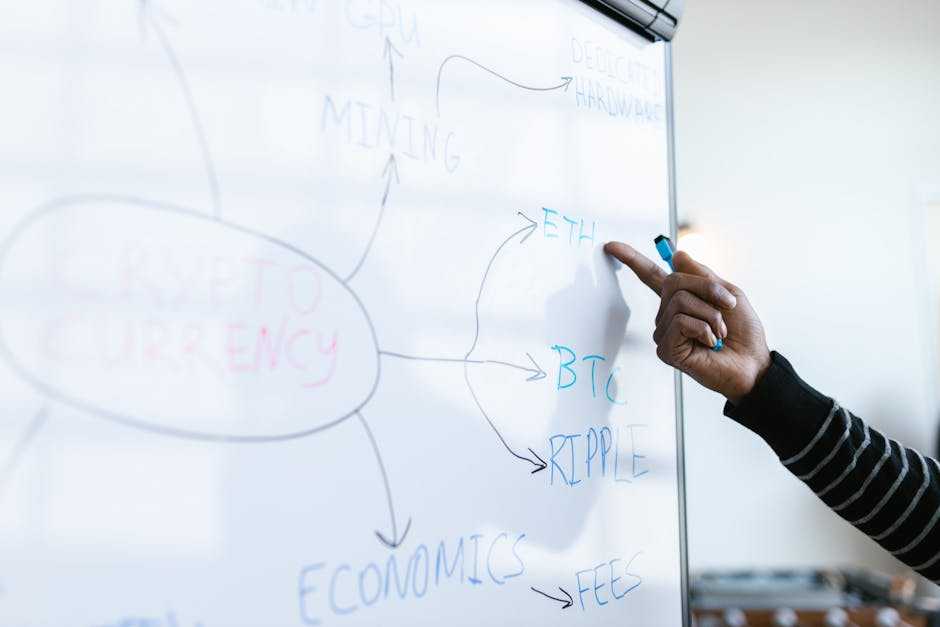

Introduction of Alternative Cryptocurrencies

Bitcoin’s success inspired the creation of alternative cryptocurrencies, also called altcoins. Notable examples include Litecoin, introduced in 2011 by Charlie Lee, and Ripple (XRP), which focuses on real-time gross settlements and remittances.

These altcoins aimed to improve on Bitcoin’s limitations, like transaction speed and energy consumption. Over time, thousands of cryptocurrencies emerged, each targeting different use cases and optimizing specific aspects of blockchain, broadening blockchain’s utility and appeal.

The Rise of Ethereum and Smart Contracts

Ethereum, launched by Vitalik Buterin in 2015, revolutionized blockchain by introducing smart contracts. These self-executing contracts run on Ethereum’s blockchain, enabling decentralized applications (dApps) to function without intermediaries.

Ethereum’s impact was profound, fostering innovations like decentralized finance (DeFi) and non-fungible tokens (NFTs).

Smart contracts automated complex transactions, making processes more efficient and transparent.

Ethereum’s flexibility and programmability distinguished it from Bitcoin, establishing it as a critical pillar of the blockchain ecosystem.

The ICO Boom and Regulation

The rise of Initial Coin Offerings (ICOs) marked another pivotal phase in blockchain’s evolution. ICOs provided a new way for startups to raise capital by issuing tokens on the blockchain in exchange for cryptocurrency.

This method peaked in 2017, with numerous projects raising billions of dollars. However, the lack of regulation led to fraud and scams, prompting governments and regulatory bodies to intervene.

The US Securities and Exchange Commission (SEC) increased scrutiny on ICOs, classifying many tokens as securities. This regulatory landscape continues to evolve, balancing innovation and investor protection.

Blockchain Beyond Cryptocurrencies

While blockchain started with cryptocurrencies, it’s now a transformative force in multiple sectors.

Enterprise Adoption: Supply Chain, Healthcare, and More

Enterprises utilize blockchain for various applications. In supply chain management, blockchain enhances transparency and traceability.

For example, companies like IBM use blockchain to track food from farm to table, improving safety and reducing waste. In healthcare, blockchain secures patient data and streamlines medical records management.

Organizations like MediLedger develop platforms that ensure data integrity and interoperability. Beyond these, blockchain finds uses in industries like real estate, where it simplifies property transactions, and in entertainment, providing clear royalty distributions.

Government Use Cases and Legal Aspects

Governments increasingly explore blockchain for public sector improvements. Estonia leverages blockchain to maintain secure citizen data and digital identities, enhancing e-governance.

In the legal domain, blockchain helps maintain transparent land registries and smart contracts streamline legal processes. However, governments must navigate complex regulations to implement blockchain solutions effectively.

In the US, regulatory bodies like the SEC provide guidelines for blockchain-based financial instruments, ensuring compliance and security.

Blockchain in Finance: From Banks to DeFi

Blockchain significantly impacts finance. Traditional banks use blockchain to speed up transactions and reduce costs. J.P. Morgan’s JPM Coin exemplifies this trend, facilitating instant settlement.

DeFi, or Decentralized Finance, revolutionizes financial services by eliminating intermediaries. Platforms like Uniswap allow peer-to-peer trading, reducing fees and increasing accessibility.

Additionally, stablecoins, which are blockchain-based assets pegged to fiat currencies, offer stability in the volatile crypto market.

Scalability and Technological Advancements

Scalability has been a primary challenge for blockchain technology. To address this, various technological advancements have emerged, enhancing the efficiency and security of blockchain networks.

Layer 2 Solutions and Sidechains

Layer 2 solutions and sidechains improve blockchain scalability. Layer 2 solutions like the Lightning Network enable faster transactions by handling them off-chain and consolidating results back onto the main blockchain.

Sidechains, such as Liquid Network, operate parallel to the main blockchain bringing additional features and reduced transaction loads. These methods significantly alleviate congestion, making blockchain networks more usable in everyday applications.

Consensus Mechanisms: PoW, PoS, and Beyond

Consensus mechanisms are pivotal for the secure operation of blockchain networks. Proof of Work (PoW), employed by Bitcoin, requires miners to solve complex mathematical problems.

Proof of Stake (PoS), utilized by Ethereum 2.0, selects validators based on their stake in the network, offering energy efficiency and faster validation times.

Emerging mechanisms, like Proof of Authority (PoA) and Delegated Proof of Stake (DPoS), further enhance network efficiency by streamlining validation processes through trusted or elected nodes.

Security Enhancements and Privacy Protocols

Security enhancements and privacy protocols are vital for blockchain technology. Advanced cryptographic methods like Zero-Knowledge Proofs (ZKPs) enable verification of transactions without revealing underlying data.

Multi-signature (multi-sig) wallets enhance security by requiring multiple approvals for a transaction.

Privacy-oriented blockchains, such as Monero and Zcash, incorporate protocols like Ring Signatures and zk-SNARKs to maintain user anonymity. These innovations ensure that blockchain technology remains secure and private, meeting the needs of various users.

This structured approach to scalability and technological advancements ensures that blockchain technology evolves efficiently and securely.

The Current State of Blockchain and Its Future

Blockchain technology continues to evolve, impacting various sectors with its advancements. Numerous trends and innovations shape its current state.

Market Trends and Innovations

The blockchain market is expanding with increasing institutional adoption. Companies like IBM and Microsoft integrate blockchain into their operations. Decentralized Finance (DeFi) platforms, such as MakerDAO, gain traction, offering decentralized financial services.

Non-Fungible Tokens (NFTs) revolutionize digital ownership, with platforms like OpenSea becoming mainstream marketplaces. Supply chain management solutions improve transparency and traceability, with IBM Food Trust as a prime example.

Challenges and Opportunities

- Despite growth, blockchain faces scalability and interoperability challenges.

- Public blockchains, such as Ethereum, struggle with high transaction fees and slow speeds during peak times.

- Scalability solutions, like Ethereum 2.0 and Layer 2 protocols (e.g., Polygon), aim to address these issues.

- Interoperability projects like Polkadot and Cosmos seek to enable seamless cross-blockchain communication. H

- Regulatory uncertainties still pose significant obstacles, with varying global approaches to blockchain governance.

Predictions and Future Prospects

Blockchain’s future holds promising advancements. As scalability solutions mature, blockchain networks will handle higher transaction volumes efficiently. Interoperability will enable diverse blockchains to interact seamlessly, fostering a more connected ecosystem.

Central Bank Digital Currencies (CBDCs) will emerge, with countries like China leading the way with the Digital Yuan. The integration of blockchain in sectors like:

- supply chain

- healthcare

- finance

will deepen, enhancing transparency and efficiency. Technological innovations, such as quantum-resistant algorithms, will bolster security. Blockchain’s evolution will continue, driving transformative changes across industries.

Chief Content Strategist & Unique Author

Paulo Okellyansy is the Chief Content Strategist responsible for curating and managing the platform’s editorial direction. With an in-depth knowledge of cryptocurrency markets and digital finance, Paulo crafts engaging, informative content that resonates with both newcomers and seasoned crypto enthusiasts. His ability to simplify complex topics and identify emerging trends has helped position the website as a go-to resource for cryptocurrency insights.

Chief Content Strategist & Unique Author

Paulo Okellyansy is the Chief Content Strategist responsible for curating and managing the platform’s editorial direction. With an in-depth knowledge of cryptocurrency markets and digital finance, Paulo crafts engaging, informative content that resonates with both newcomers and seasoned crypto enthusiasts. His ability to simplify complex topics and identify emerging trends has helped position the website as a go-to resource for cryptocurrency insights.