Understanding Smart Contracts

Smart contracts revolutionize transaction processes. These self-executing contracts contain terms directly written into lines of code, stored on blockchain technology. They’re designed to facilitate, verify, and enforce contractual agreements without intermediaries.

Key Characteristics

- Automation: Transactions execute automatically when predefined conditions are met, reducing the need for third-party involvement.

- Security: Blockchain’s decentralized nature ensures data is immutable and transparent, which minimizes fraud.

- Efficiency: Without human intermediaries, smart contracts complete transactions faster and cheaper compared to traditional methods.

Practical Examples

- Financial Services: Automating loan disbursement and repayment based on predefined conditions.

- Supply Chain Management: Verifying product origin and tracking its journey through various checkpoints.

- Legal Agreements: Executing employment contracts or real estate deals, reducing legal costs.

How It Works

- Deployment: A developer writes the smart contract code, specifying conditions and outcomes, then deploys it on the blockchain.

- Execution: Once conditions are met, the smart contract automatically executes the terms.

- Verification: The blockchain verifies that the terms are met before processing the transaction, ensuring accuracy.

- Reduced Costs: Eliminating intermediaries lowers transaction fees.

- Increased Trust: Transparent code and immutable records enhance trust between parties.

- Time Savings: Automation speeds up transaction processes.

Smart contracts, with their decentralized nature and automated execution, offer robust solutions for various industries, significantly streamlining and securing contracts.

Key Components of Smart Contracts

Smart contracts rely on several core components to function effectively. Understanding these elements helps in grasping how smart contracts operate within blockchain ecosystems.

Blockchain Technology

Blockchain technology forms the foundation of smart contracts. Stored on decentralized ledgers, these contracts ensure transparency and immutability. Each transaction gets recorded on a block, which is then linked to previous blocks, creating a secure chain.

The blockchain’s decentralized nature prevents tampering, providing a trustless environment where parties don’t need intermediaries to verify transactions.

Cryptographic Security

Cryptographic security underpins the reliability of smart contracts. Algorithms encrypt the data within the contracts, making unauthorized alterations virtually impossible.

Public and private keys authenticate parties involved, ensuring only authorized individuals execute or access the contract. This level of security adds a robust layer of protection against fraud and hacking.

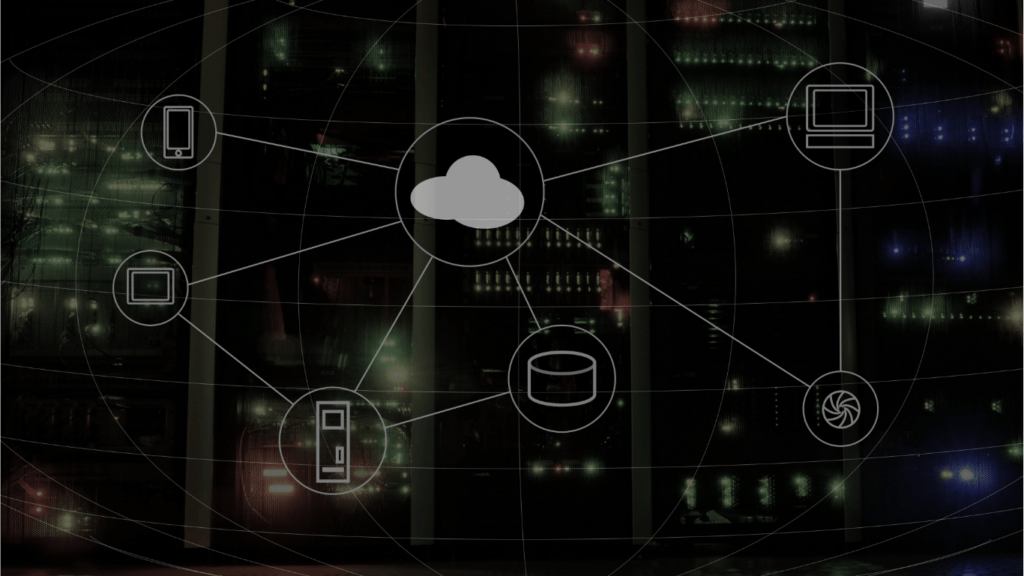

Decentralization

Decentralization is a key feature that differentiates smart contracts from traditional contracts. Without a central authority, these contracts operate on a network of nodes. Each node verifies and records transactions, ensuring consensus through complex algorithms. This distributed approach reduces the risk of a single point of failure, enhancing the resilience and reliability of smart contracts in various applications.

How Smart Contracts Work

Smart contracts operate through code stored on a blockchain, executing automatically based on predefined conditions.

Creation and Deployment

Developers create smart contracts using programming languages like Solidity and Vyper. They encode the contract terms into the blockchain network. Once developed, they deploy the contract on a blockchain like Ethereum. This deployment involves converting the code into bytecode and sending it to the blockchain, where it becomes immutable.

Execution and Verification

When predefined conditions within the smart contract are met, the contract self-executes. This execution process is verified by blockchain nodes, ensuring accuracy and preventing fraud. For example, a supply chain contract may release payment automatically once goods are delivered and confirmed.

Benefits Over Traditional Contracts

Smart contracts offer significant advantages over traditional contracts. They eliminate intermediaries, reducing costs and delays. Blockchain technology ensures transparency and immutability, enhancing trust among involved parties. Also, automated execution and decentralized operations increase reliability and efficiency in contract management.

Use Cases of Smart Contracts

Smart contracts revolutionize various industries by enhancing automation, security, and efficiency. Below are some key areas where they have significant impacts.

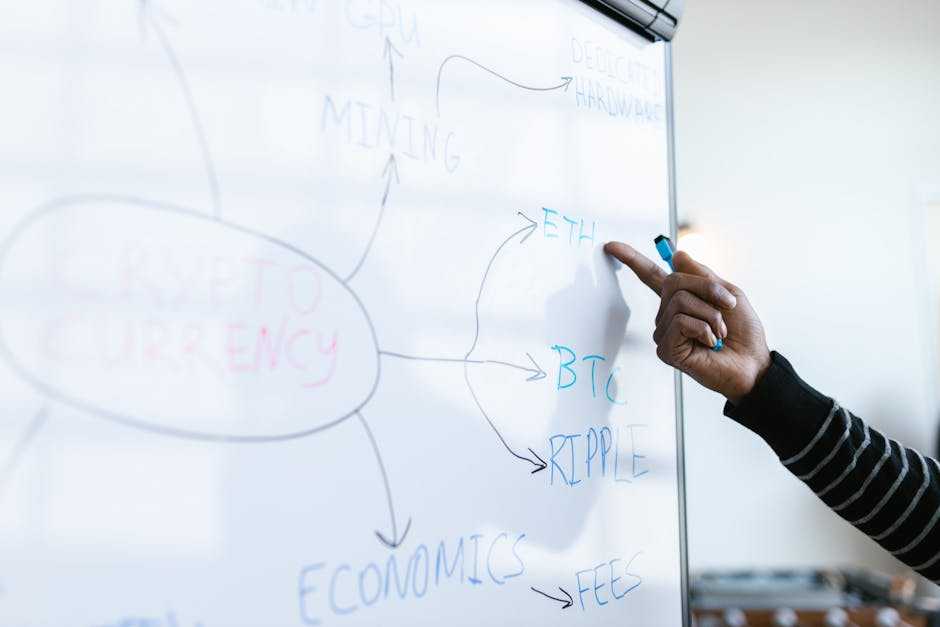

Financial Transactions

Smart contracts streamline financial transactions by automating processes like payments, transfers, and escrow services. They remove intermediaries, reducing costs and delays.

For instance, in securities trading, smart contracts enable automatic settlement and clearing, ensuring quick and accurate transactions. Cross-border payments through smart contracts minimize the need for traditional banking systems, lowering transaction fees and improving transfer speeds.

Supply Chain Management

Supply chain management benefits from the transparency and traceability of smart contracts. They track product movement from production to delivery, ensuring visibility at every stage.

By automating procedures such as shipment updates and payment releases, companies can optimize operations and reduce fraud. For example, when a shipment reaches a specified location, a smart contract can automatically trigger a payment to the supplier, streamlining the entire process.

Legal Agreements

In the legal field, smart contracts enforce legal agreements without manual intervention. They ensure compliance with terms and conditions by executing predefined code. This reduces the need for legal intermediaries and lowers costs.

For instance, insurance claims can be processed automatically based on predefined event triggers like natural disasters, improving efficiency and speed. Real estate transactions also benefit, as smart contracts handle tasks like title transfers and escrow accounts securely and transparently.

Challenges and Limitations

Smart contracts offer numerous benefits but face several challenges and limitations. It’s crucial to understand these to properly harness their potential.

Scalability Issues

Blockchain scalability significantly impacts smart contracts. Limited transaction throughput can lead to network congestion, as seen in Ethereum’s network during high-traffic events like Initial Coin Offerings (ICOs) and popular decentralized applications (dApps).

Smart contracts need scalable blockchain platforms, but most current options struggle to handle high volumes without compromising performance.

Legal and Regulatory Concerns

The legal status of smart contracts varies globally. Ambiguities around enforceability, jurisdiction, and compliance with existing laws complicate their adoption.

For example, while some jurisdictions recognize them as legally binding, others lack clear regulatory guidance. This inconsistency creates uncertainty for businesses and individuals looking to implement smart contracts.

Security Vulnerabilities

Smart contracts, despite their secure nature, aren’t immune to security risks. Coding errors and vulnerabilities can lead to exploits. Notable incidents like the DAO hack in 2016 highlighted the potential for catastrophic losses due to flaws in smart contract code.

Rigorous testing and auditing are essential to mitigate these risks, but they can’t eliminate them entirely.

Chief Content Strategist & Unique Author

Paulo Okellyansy is the Chief Content Strategist responsible for curating and managing the platform’s editorial direction. With an in-depth knowledge of cryptocurrency markets and digital finance, Paulo crafts engaging, informative content that resonates with both newcomers and seasoned crypto enthusiasts. His ability to simplify complex topics and identify emerging trends has helped position the website as a go-to resource for cryptocurrency insights.

Chief Content Strategist & Unique Author

Paulo Okellyansy is the Chief Content Strategist responsible for curating and managing the platform’s editorial direction. With an in-depth knowledge of cryptocurrency markets and digital finance, Paulo crafts engaging, informative content that resonates with both newcomers and seasoned crypto enthusiasts. His ability to simplify complex topics and identify emerging trends has helped position the website as a go-to resource for cryptocurrency insights.