Understanding NFTs

NFTs, or Non-Fungible Tokens, represent unique digital assets that can’t be exchanged on a one-to-one basis like cryptocurrencies. Each NFT holds distinctive characteristics that set it apart.

Definition and Characteristics

NFTs are digital assets verified using blockchain technology. Unlike cryptocurrencies which are fungible, meaning one Bitcoin is equivalent to another, NFTs are one-of-a-kind. Each NFT has a distinct value and cannot be replaced with another. They utilize Ethereum’s ERC-721 and ERC-1155 standards, enabling the creation and transfer of unique tokens.

Popular Use Cases

NFTs attract attention in various sectors. In the art sector, artists digitize and sell their artwork as NFTs, ensuring authenticity and ownership. Music artists release their songs as NFTs, providing exclusive content to buyers. Virtual real estate platforms like Decentraland allow users to purchase digital land parcels as NFTs, which can then be developed or traded. NFTs also have uses in gaming, offering in-game assets, characters, and skins as tradable NFTs.

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual currencies using cryptography for security. Unlike NFTs, they are fungible and standardized.

Definition and Characteristics

Cryptocurrencies are decentralized digital assets based on blockchain technology. Bitcoin, introduced in 2009 by an anonymous person or group known as Satoshi Nakamoto, was the first cryptocurrency. Unlike fiat currencies, cryptocurrencies operate without a central authority, relying on a network of computers (nodes) to validate and record transactions.

Cryptocurrencies use cryptographic principles to secure transactions, control new unit creation, and verify asset transfer. Blockchain technology ensures transparency, immutability, and decentralization. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Popular Use Cases

Popular use cases for cryptocurrencies include peer-to-peer transactions, remittances, and investment. Users can send and receive cryptocurrencies directly from one wallet to another without intermediaries.

This feature makes cryptocurrencies ideal for cross-border remittances, reducing time and transaction costs. Many people also invest in cryptocurrencies, treating them as digital assets with the potential for high returns.

Beyond transactions and investment, some platforms use cryptocurrencies for smart contracts, decentralized finance (DeFi), and gaming. Ethereum, for instance, supports smart contracts that autonomously execute specified actions based on predefined conditions.

Key Differences Between NFTs and Cryptocurrencies

Understanding the key differences between NFTs and cryptocurrencies is pivotal for anyone navigating digital assets. Each serves distinct purposes within the blockchain landscape.

Nature of Value

NFTs derive value from their uniqueness and scarcity. Each NFT is a one-of-a-kind digital asset that represents ownership of a specific item or piece of content, such as digital art or virtual real estate. Cryptocurrencies, like:

- Bitcoin

- Ethereum

have value rooted in their fungibility and utility. Each unit is interchangeable with another and can be used for transactions or as a store of value.

Transaction Mechanisms

NFT transactions hinge on smart contracts that define the unique properties and ownership records of the digital asset. These transactions often occur on specialized marketplaces like OpenSea or Rarible.

Cryptocurrency transactions rely on blockchain technology to validate and record exchanges in a decentralized ledger. Users trade them on platforms like Coinbase or Binance for various purposes, including purchases and investments.

Ownership and Transferability

NFTs offer clear proof of ownership, which is embedded in the blockchain ledger. This ownership is immutable and transferable only through a new transaction. Owning a cryptocurrency means holding a certain quantity of digital coins, stored in a digital wallet and transferable with relative ease. Both types of digital assets leverage blockchain technology to ensure secure and transparent ownership records.

Financial Implications

NFTs and cryptocurrencies affect financial landscapes differently. It’s essential to grasp these distinctions if you’re considering investments in digital assets.

Investment Potential

NFTs offer unique investment opportunities. Unlike cryptocurrencies, their value stems from rarity and demand for the specific digital asset. Investors often purchase NFTs in hopes of reselling them at higher prices. High-profile NFT sales, like Beeple’s digital artwork auctioned for $69 million, demonstrate significant profit potential but also come with higher risks.

Cryptocurrencies, on the other hand, derive value from utility and acceptance as digital currency. Bitcoin and Ethereum, the most prominent examples, have seen substantial growth over the years. Investors view them as store-of-value assets, similar to gold. While potential gains are substantial, they tend to carry high volatility.

Market Volatility

NFT markets often see price fluctuations based on the fame of the creator or the uniqueness of the item. The value can drop if the interest or novelty wears off. This speculative nature makes them riskier.

Cryptocurrencies are known for their high volatility. Factors causing price swings include regulatory news, macroeconomic changes, and technological developments. Despite this volatility, major cryptocurrencies like Bitcoin and Ethereum have sustained long-term growth trends, attracting institutional investments.

Investors in both NFTs and cryptocurrencies must be aware of these financial implications. Comprehensive research and risk assessment are crucial for making informed decisions.

Legal and Regulatory Aspects

NFTs and cryptocurrencies face different legal and regulatory landscapes due to their distinct functions and impacts.

Current Regulations

- NFTs operate within a fragmented regulatory environment since their legal status varies by region.

- In the US, the SEC hasn’t classified NFTs as securities yet, but their characteristics might bring them under future regulations.

- In the EU, NFTs generally fall outside the Markets in Financial Instruments Directive (MiFID II), but specific applications can change this status.

- Cryptocurrencies face more stringent regulations due to their widespread use as digital currencies.

- US regulations by the SEC classify some cryptocurrencies as securities, requiring compliance with securities laws.

- The IRS treats cryptocurrencies as property, mandating tax reporting for transactions. In the EU, cryptocurrencies fall under the Fifth Anti-Money Laundering Directive (5AMLD), enforcing identity verification and reporting requirements.

Future Outlook

NFT regulations will likely become clearer as their usage expands. Increased market activity and high-value transactions could prompt stricter oversight. Uniform global standards may emerge to facilitate cross-border transactions and legal clarity.

Cryptocurrencies will continue to see strengthened regulations. Regulatory bodies might introduce laws to ensure financial stability and protect investors. Central Bank Digital Currencies (CBDCs) could impact existing cryptocurrency regulations, potentially harmonizing international standards and reducing regulatory arbitrage.

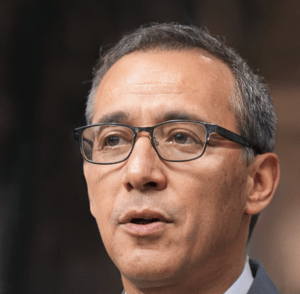

Founder & CEO

Daniel Anderson is the visionary founder and CEO of the website, leading the charge in revolutionizing the crypto space. With a deep understanding of blockchain technology and years of experience in the industry, Daniel has established himself as a key figure in the cryptocurrency world. His passion for decentralization and financial innovation drives the platform’s mission to deliver cutting-edge insights and resources for crypto enthusiasts, traders, and investors. Under his leadership, the website has grown into a trusted hub for the latest trends, news, and developments in the digital asset space.

Founder & CEO

Daniel Anderson is the visionary founder and CEO of the website, leading the charge in revolutionizing the crypto space. With a deep understanding of blockchain technology and years of experience in the industry, Daniel has established himself as a key figure in the cryptocurrency world. His passion for decentralization and financial innovation drives the platform’s mission to deliver cutting-edge insights and resources for crypto enthusiasts, traders, and investors. Under his leadership, the website has grown into a trusted hub for the latest trends, news, and developments in the digital asset space.