Understanding Decentralization

Decentralization distributes control across multiple entities, ensuring that no single node has overarching authority. This means that decisions and validations arise through consensus, not a central point of failure.

Blockchain epitomizes this structure by using a peer-to-peer network where each node keeps an identical copy of the ledger. This transparency enhances trust and security since tampering with one node doesn’t affect the overall system’s integrity.

For instance, Bitcoin, one of the most well-known blockchain applications, relies on decentralized protocols to enable peer-to-peer transactions without intermediaries. Users benefit from lower transaction fees and increased privacy. Nodes validate transactions through consensus algorithms, making it difficult for any malicious entity to alter data.

Decentralization also improves system resilience. In cases of localized failures, network operations continue unaffected because no single point manages the entire network. This robustness is evident in various blockchain applications across finance, supply chains, and voting systems.

Key features of decentralization include:

- Transparency: All participants can access and verify transaction data.

- Security: Distributed control reduces susceptibility to attacks and fraud.

- Efficiency: Eliminates intermediaries, leading to faster and cheaper transactions.

- Resilience: System continues to operate seamlessly even if parts are compromised.

Decentralization empowers users by providing more control and reducing reliance on central authorities, making digital interactions more secure and efficient.

Importance of Decentralization in Blockchain

Decentralization plays a crucial role in the effectiveness and robustness of blockchain technology. By distributing control, it addresses key issues in data management and digital transactions.

Security Enhancements

Decentralization significantly boosts security in blockchain networks. Without a central point of failure, hacking attempts become exponentially harder. For instance, in Bitcoin’s network, thousands of nodes validate transactions, making it practically impossible to alter data unilaterally.

Unlike centralized systems, where breaching a single server could compromise the entire network, decentralized structures distribute this risk across multiple nodes, ensuring enhanced data integrity and security.

Trustless Transactions

Decentralized blockchain networks enable trustless transactions. These transactions eliminate the need for intermediaries, relying instead on consensus algorithms to validate actions. As a result, users can engage in peer-to-peer exchanges without third-party oversight.

For example, Ethereum’s smart contracts autonomously execute agreements when predefined conditions are met, streamlining processes and reducing associated costs. This trustless mechanism ensures transparency and reliability, reinforcing user confidence without the necessity of a central authority.

Key Components of Decentralized Systems

Decentralized systems rely on several key components to maintain security, transparency, and efficiency in blockchain networks. These elements work together to ensure that no single entity can control the network.

Nodes and Consensus Mechanisms

Nodes are the backbone of decentralized systems. Every node represents a computer that participates in the blockchain network, storing a copy of the ledger and validating transactions. By distributing these nodes globally, the system remains resilient to localized failures and attacks.

Consensus mechanisms are protocols that help nodes agree on the state of the blockchain. Examples include Proof of Work (PoW) and Proof of Stake (PoS). PoW, used by Bitcoin, requires computational power to solve complex mathematical problems.

Nodes (miners) compete to find the solution, and the first to do so gets to add a new block to the blockchain. PoS, used by Ethereum 2.0, assigns the task of creating new blocks to nodes based on the number of cryptocurrency tokens they hold and are willing to lock up as collateral. These mechanisms ensure consistency and security across all nodes, preventing fraudulent transactions.

Public and Private Keys

Public and private keys are essential for securing transactions in decentralized systems. Public keys are like addresses: they can be shared with others to receive funds. Private keys, however, must remain secret. They’re used to sign transactions, providing proof that the owner of the funds has authorized the transaction without revealing the private key itself.

For example, if I want to send Bitcoin to someone, I’ll use my private key to sign the transaction. The network uses my public key to verify the signature, ensuring that it’s authentic. This cryptographic method prevents unauthorized access and maintains the integrity and confidentiality of transactions.

Benefits of Decentralized Blockchain

Decentralized blockchain technology offers several significant advantages that reshape data security, transparency, and efficiency.

Transparency and Immutability

Decentralized blockchains ensure transparency by recording all transactions on a public ledger. Each transaction is visible to all network participants, promoting openness and accountability. For instance, in supply chains, stakeholders can track product origins and movements, ensuring legitimacy and quality.

Immutability is another cornerstone. Once added to the blockchain, transactions cannot be altered or deleted, ensuring a tamper-proof record. This feature builds trust, as stakeholders know data remains accurate and unchanged.

Reduced Fraud and Corruption

Decentralization minimizes the risk of fraud and corruption through distributed control. In traditional systems, a central authority could be compromised, leading to fraud. In contrast, decentralized networks distribute authority among multiple nodes, making it nearly impossible for a single entity to manipulate the system.

Consensus mechanisms, like PoW and PoS, validate transactions securely, ensuring only legitimate actions are recorded. This reduces fraudulent activities and corruption, enhancing the system’s overall integrity. In financial systems, this transparency and security can prevent issues like double-spending, ensuring robust and reliable operations.

Challenges and Limitations

While decentralization offers numerous benefits, it faces certain challenges and limitations that must be addressed for widespread adoption and optimal functioning.

Scalability Issues

Scalability presents a significant challenge for decentralized systems like blockchain. Current blockchain networks struggle to handle high transaction volumes without compromising speed or efficiency.

For example, Bitcoin processes about 7 transactions per second (TPS), while Ethereum handles around 30 TPS. In contrast, traditional centralized systems like Visa process up to 24,000 TPS. Solutions like sharding and off-chain transactions aim to enhance scalability, but widespread implementation remains complex and resource-intensive.

Regulatory Concerns

Regulatory concerns pose another limitation to decentralization. Blockchain operates across borders, making it challenging to align with various national regulations. Regulatory bodies struggle to manage compliance, anti-money laundering (AML), and know-your-customer (KYC) protocols within decentralized frameworks.

For instance, the European Union’s General Data Protection Regulation (GDPR) raises issues regarding data immutability and user privacy in blockchain. Balancing innovation and regulatory compliance requires clear guidelines and international cooperation to avoid impeding blockchain’s potential.

Real-World Applications of Decentralization

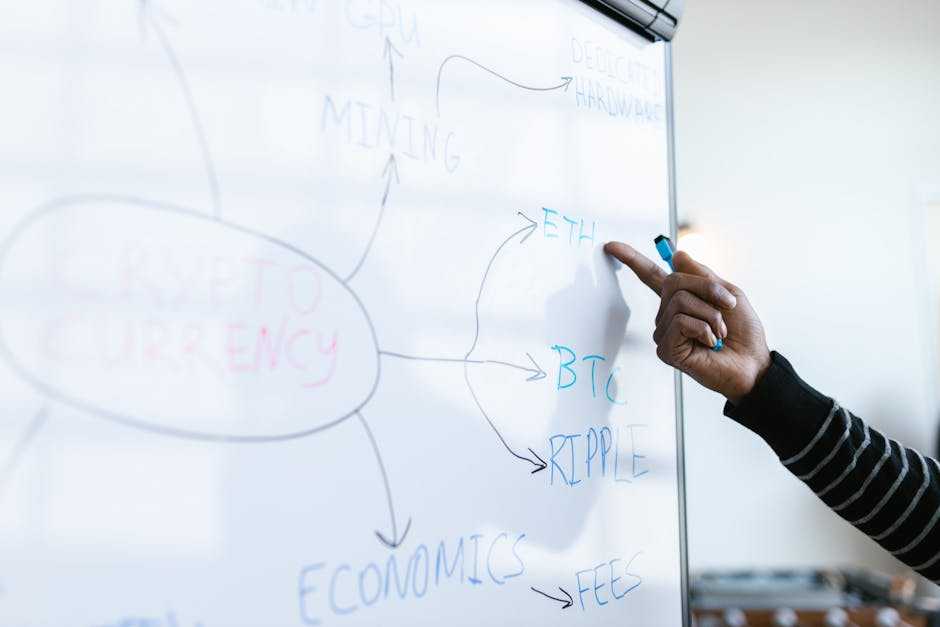

Decentralization touches several industries, proving its value beyond theoretical discussions. It’s particularly impactful in cryptocurrencies and decentralized finance (DeFi).

Cryptocurrencies

- Cryptocurrencies, like Bitcoin and Ethereum, are the most well-known applications of decentralization.

- These digital currencies operate without a central authority, relying on peer-to-peer networks to process transactions.

- This eliminates intermediaries like banks, reducing costs and increasing transaction speed.

- Bitcoin, for instance, uses a decentralized ledger to ensure all transactions are transparent and immutable, making fraud nearly impossible.

- Ethereum extends the idea by enabling smart contracts, which automate and enforce agreements, expanding the use cases beyond simple transactions.

Decentralized Finance (DeFi)

DeFi platforms leverage blockchain to recreate traditional financial systems, like lending and trading, in a decentralized manner. Projects like Aave and Uniswap allow users to lend, borrow, and trade assets without intermediaries.

This decentralization reduces fees and increases accessibility, especially important for individuals in regions with limited banking services. Smart contracts automate these processes, ensuring trust and efficiency.

Unlike traditional finance, DeFi offers global access and operates 24/7, providing continuous financial services without geographical or operational constraints.

Future of Decentralization in Blockchain Technology

Decentralization’s relevance in blockchain technology continues to grow. Innovations in consensus mechanisms, such as proof-of-stake (PoS) and delegated proof-of-stake (DPoS), are improving scalability and energy efficiency. These advancements address current limitations while maintaining decentralization’s core principles.

Emerging decentralized applications (dApps) promise transformative impacts across industries. For instance, supply chain management utilizes blockchain’s transparency to track goods, ensuring authenticity and reducing fraud. In healthcare, decentralized data storage ensures patient information is secure yet accessible to authorized personnel.

Interoperability solutions are crucial for the future of decentralization. Projects like Polkadot and Cosmos enable different blockchains to communicate, enhancing functionality and connectivity. This interconnectedness supports a more robust and versatile blockchain ecosystem.

Regulatory landscapes will shape decentralization’s trajectory. While governments worldwide are recognizing blockchain’s potential, balancing innovation with regulation remains critical. Thoughtful policymaking can foster growth while protecting consumers and maintaining market integrity.

As the technology matures, decentralization in blockchain will increasingly influence various sectors, from finance to supply chains. By overcoming current challenges and leveraging innovative solutions, the future of decentralization looks promising and expansive.

Founder & CEO

Daniel Anderson is the visionary founder and CEO of the website, leading the charge in revolutionizing the crypto space. With a deep understanding of blockchain technology and years of experience in the industry, Daniel has established himself as a key figure in the cryptocurrency world. His passion for decentralization and financial innovation drives the platform’s mission to deliver cutting-edge insights and resources for crypto enthusiasts, traders, and investors. Under his leadership, the website has grown into a trusted hub for the latest trends, news, and developments in the digital asset space.

Founder & CEO

Daniel Anderson is the visionary founder and CEO of the website, leading the charge in revolutionizing the crypto space. With a deep understanding of blockchain technology and years of experience in the industry, Daniel has established himself as a key figure in the cryptocurrency world. His passion for decentralization and financial innovation drives the platform’s mission to deliver cutting-edge insights and resources for crypto enthusiasts, traders, and investors. Under his leadership, the website has grown into a trusted hub for the latest trends, news, and developments in the digital asset space.