Understanding Blockchain Technology

Blockchain technology serves as the backbone of decentralized systems by ensuring data integrity and transparency. Each block in the blockchain contains a list of transactions, which are time-stamped and linked to the previous block, forming a chain.

This structure ensures that once data is recorded, it can’t be altered without altering all subsequent blocks, adding robust security to the system.

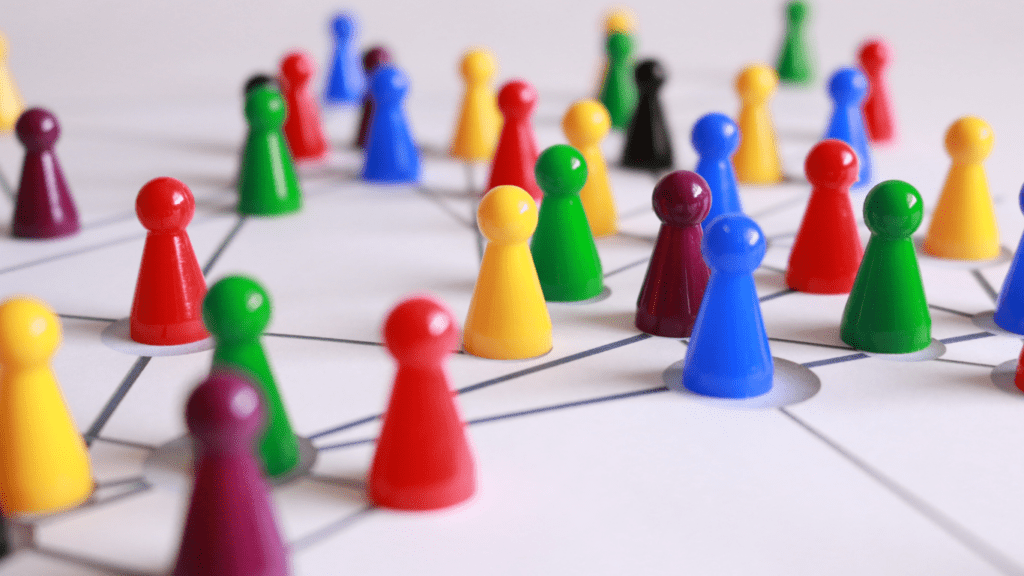

The decentralized nature of blockchain means that no single entity controls the data. Instead, multiple nodes (computers) in the network maintain and verify the ledger, making it difficult for any single node to gain control and manipulate the data. This multi-node verification process enhances trust and reduces the risk of fraud.

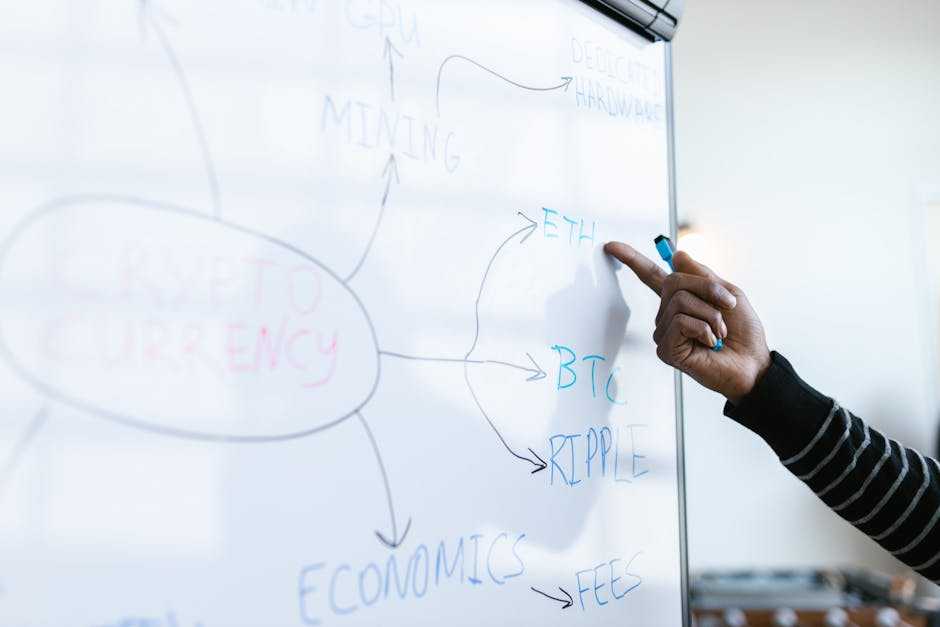

Consensus mechanisms play a crucial role in achieving agreement among nodes in the blockchain. These mechanisms, like Proof of Work (PoW) and Proof of Stake (PoS), determine how transactions are validated and added to the blockchain.

PoW, used by Bitcoin, requires miners to solve complex mathematical problems, which demands significant computational power. In contrast, PoS, adopted by Ethereum, requires validators to hold a certain amount of cryptocurrency, reducing the need for extensive computational resources.

Smart contracts further expand blockchain’s capabilities. These self-executing contracts with terms directly written into code automate and enforce agreements, eliminating the need for intermediaries. For example, in a supply chain, smart contracts can automatically transfer ownership of goods when conditions are met, streamlining operations.

Blockchain technology’s transparency stems from its public ledger, accessible to anyone within the network. This transparency not only builds trust but also allows for real-time auditing and eliminates the need for a centralized authority.

By understanding these core aspects, one can grasp why blockchain represents a significant shift in how we handle data, especially in sectors requiring high security and transparency.

What Are Consensus Mechanisms?

Consensus mechanisms are foundational protocols in blockchain technology that ensure all participants agree on the data’s validity and order.

Definition and Importance

Consensus mechanisms refer to methods by which decentralized systems like blockchain achieve agreement among distributed nodes on the network.

These protocols are crucial because they maintain data integrity, prevent fraud, and enable trustless environments. Without consensus, blockchains would face inconsistencies, potentially leading to incorrect transaction records or security vulnerabilities.

Various Types of Consensus Mechanisms

Several consensus mechanisms exist, each with unique characteristics:

- Proof of Work (PoW): Requires nodes to solve complex mathematical puzzles. Bitcoin uses PoW, which demands significant computational power to validate transactions.

- Proof of Stake (PoS): Relies on validators who hold and lock up cryptocurrency as a stake. Ethereum 2.0 and Cardano utilize PoS to enhance energy efficiency and encourage participation from holders.

- Delegated Proof of Stake (DPoS): Allows stakeholders to vote for delegates who validate transactions on their behalf. EOS and Tron leverage DPoS for faster transaction processing.

- Practical Byzantine Fault Tolerance (PBFT): Involves nodes reaching consensus even if some act maliciously. Hyperledger Fabric employs PBFT to operate in permissioned networks.

- Proof of Authority (PoA): Entails a select number of trustworthy nodes authorized to validate transactions. VeChain and certain private blockchains apply PoA for enhanced speed and efficiency.

These mechanisms serve as the backbone of blockchain networks, securing transactions and maintaining decentralized consensus across the globe.

Proof of Work vs. Proof of Stake

Proof of Work (PoW) and Proof of Stake (PoS) are two of the most prominent consensus mechanisms in blockchain technology. Both ensure transaction validation and network security but differ in their methods and efficiency.

Key Differences

Proof of Work (PoW) requires miners to solve complex mathematical puzzles to validate transactions. This process involves substantial computational power and energy consumption. Bitcoin and Ethereum (before its transition to PoS) are prime examples using PoW.

Proof of Stake (PoS), on the other hand, selects validators based on the number of coins they hold and are willing to “stake” as collateral. This approach reduces energy consumption and aims for better scalability. Ethereum 2.0 and Cardano are notable examples leveraging PoS.

| Aspect | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Method | Solving complex puzzles | Staking coins |

| Energy Consumption | High | Low |

| Transaction Speed | Moderate | Faster |

| Security | Established and proven | Secure with economic incentives |

| Examples | Bitcoin, Ethereum (pre-2.0) | Ethereum 2.0, Cardano |

Pros and Cons of Each

Proof of Work (PoW) has the advantage of being highly secure due to its computational intensity. The extensive energy required acts as a deterrent to attacks. However, its high energy consumption and slower transaction rates are significant drawbacks. PoW also tends to centralize mining activities in regions with cheap electricity.

Proof of Stake (PoS) offers better energy efficiency and faster transaction processing. Lower energy needs make PoS more environmentally friendly. However, the system can potentially favor those with more capital, leading to wealth centralization. There are also concerns about its relative novelty compared to PoW.

| Consensus Mechanism | Pros | Cons |

|---|---|---|

| Proof of Work (PoW) | Secure, deterrent to attacks | High energy consumption, slower transactions, potential centralization of mining |

| Proof of Stake (PoS) | Energy-efficient, faster transactions, scalable | Potential for wealth centralization, less proven over time |

Emerging Consensus Mechanisms

Blockchain technology’s evolution has led to the development of new consensus mechanisms. These mechanisms aim to address the limitations of Proof of Work (PoW) and Proof of Stake (PoS) while maintaining decentralization and security.

Delegated Proof of Stake

Delegated Proof of Stake (DPoS) builds on the concept of PoS by introducing a more democratic element. Networks using DPoS allow stakeholders to vote for a small number of delegates who validate transactions and maintain the blockchain. For example, in the EOS blockchain, token holders elect 21 block producers.

These elected delegates are responsible for creating blocks and validating transactions. If a delegate fails to act in the network’s best interest, stakeholders can vote them out, ensuring accountability. This method reduces centralization risks and increases transaction speeds compared to PoS.

Proof of Authority

Proof of Authority (PoA) relies on the identity and reputation of validators rather than computational power or staked coins. In PoA, a select group of nodes, often organizations or well-known entities, validate transactions based on their trustworthiness.

For instance, the VeChain blockchain uses PoA to ensure quick and low-cost transaction verification by verifying through a list of approved nodes. While PoA compromises on decentralization, it offers high efficiency and is suitable for private or consortium blockchains requiring trusted entities to govern the network.

Practical Applications in Blockchain

Consensus mechanisms play a crucial role in a variety of blockchain applications. Different industries leverage these mechanisms to ensure secure and efficient operations.

Financial Industry

In the financial industry, blockchain consensus mechanisms like PoW and PoS provide robust transaction validation and fraud prevention. Banks use these mechanisms to process cross-border payments, ensuring that each transaction is verified and recorded immutably.

For instance, Ripple employs a unique consensus protocol to enable real-time gross settlement, reducing transaction costs and settlement times. Additionally, smart contracts on platforms like Ethereum automate loan approvals and execute trades, leveraging PoS to validate these transactions efficiently.

Supply Chain Management

Supply chain management benefits from consensus mechanisms to enhance transparency and traceability. Companies implement blockchain to track products from production to delivery, ensuring data integrity at each stage.

For example, Walmart uses blockchain to trace food products, leveraging Hyperledger Fabric’s PoA consensus for efficient and secure data validation. This application helps in quickly identifying contamination sources and prevents distribution issues, ultimately increasing consumer trust.

Challenges and Future Directions

Consensus mechanisms in blockchain face several challenges and potential future directions for improvement.

Scalability Issues

Blockchain networks struggle with scalability. As transaction volume increases, processing times slow, and fees rise. Bitcoin and Ethereum exemplify these constraints, with Bitcoin handling about 7 transactions per second (TPS) and Ethereum around 30 TPS.

To address these bottlenecks, Layer-2 solutions like Lightning Network and sidechains offer promising scalability improvements. These external networks process transactions off the main blockchain, reducing congestion and enhancing throughput.

Developers are also exploring sharding, which divides the blockchain into smaller, more manageable segments called shards, enabling parallel processing of transactions.

Energy Consumption

The environmental impact of energy consumption in consensus mechanisms, particularly Proof of Work (PoW), is significant. Bitcoin mining uses an estimated 91 TWh of electricity annually, comparable to the energy usage of entire countries like Finland. This high consumption drives the search for more sustainable alternatives.

Proof of Stake (PoS) provides a more energy-efficient method, reducing the need for power-hungry computations by relying on validators who lock up or ‘stake’ their coins. Newer models like Proof of Space and Time (PoST) and Proof of Burn (PoB) explore unique approaches to balance security and efficiency, aiming to lower the ecological footprint of blockchain operations.

Chief Content Strategist & Unique Author

Paulo Okellyansy is the Chief Content Strategist responsible for curating and managing the platform’s editorial direction. With an in-depth knowledge of cryptocurrency markets and digital finance, Paulo crafts engaging, informative content that resonates with both newcomers and seasoned crypto enthusiasts. His ability to simplify complex topics and identify emerging trends has helped position the website as a go-to resource for cryptocurrency insights.

Chief Content Strategist & Unique Author

Paulo Okellyansy is the Chief Content Strategist responsible for curating and managing the platform’s editorial direction. With an in-depth knowledge of cryptocurrency markets and digital finance, Paulo crafts engaging, informative content that resonates with both newcomers and seasoned crypto enthusiasts. His ability to simplify complex topics and identify emerging trends has helped position the website as a go-to resource for cryptocurrency insights.