Understanding Blockchain Technology

Blockchain serves as the backbone for various digital innovations, including cryptocurrencies. This decentralized ledger tech maintains data integrity and enables trustless transactions.

Key Characteristics of Blockchain

- Decentralization: No single authority controls blockchain. Computers (nodes) in the network validate and record transactions collectively.

- Immutability: Once recorded, data on the blockchain can’t be altered. This ensures transparency and trust in records.

- Transparency: Transactions are visible to anyone on the network. This open ledger supports accountability.

- Security: Data encryption and consensus algorithms safeguard information, making it resilient against fraud and hacking.

- Smart Contracts: Automated agreements execute actions when predefined conditions are met, reducing human intervention.

- Public Blockchains: Anyone can join and participate. Examples include Bitcoin and Ethereum. These networks prioritize decentralization and transparency.

- Private Blockchains: Restricted access systems. Organizations use them internally. They offer better control but less transparency.

- Consortium Blockchains: Partially decentralized with multiple organizations managing them. Suitable for industry collaborations where control and trust are balanced.

- Hybrid Blockchains: Combine public and private elements. They allow sensitive data to remain private while enabling some degree of transparency.

Each type showcases blockchain’s versatility across different applications and industries.

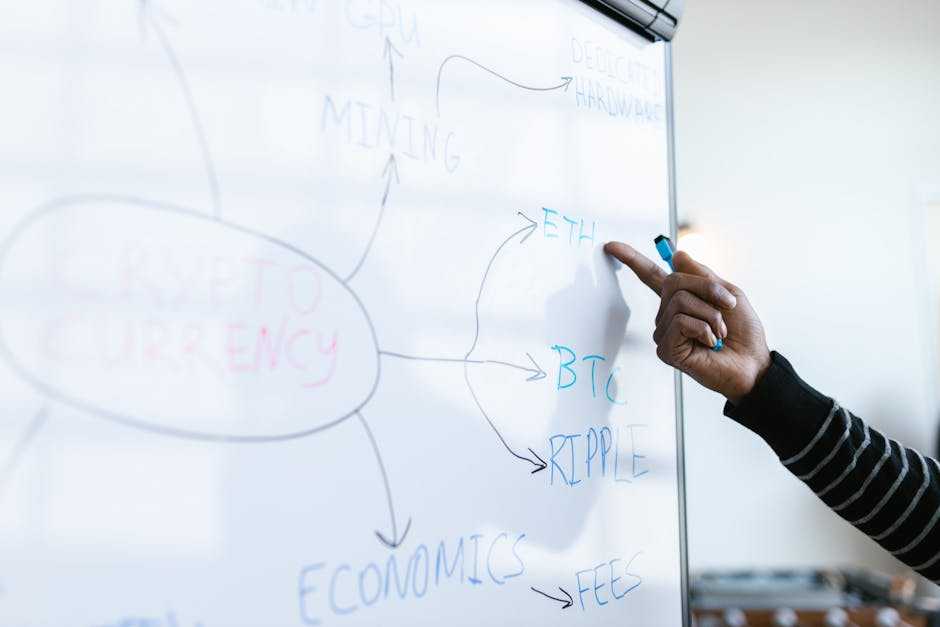

Unpacking Cryptocurrency

Cryptocurrency represents a digital or virtual currency that leverages cryptographic technology for security. Unlike traditional currencies, cryptocurrencies operate independently of central authorities.

Key Characteristics of Cryptocurrency

- Decentralization: Most cryptocurrencies use a decentralized network of nodes to validate transactions and maintain the ledger. For example, Bitcoin operates on a peer-to-peer network without a central authority.

- Transparency: Each transaction is recorded on a public ledger, usually a blockchain, that anyone can access. Ethereum, for instance, uses a transparent blockchain where all transactions are visible.

- Security: Cryptographic techniques ensure the integrity and security of transactions. Bitcoin and other cryptocurrencies use advanced encryption to protect transaction data.

- Anonymity: While transactions are transparent, the identities of the participants are often anonymized. Monero, for example, prioritizes user privacy by obscuring transaction details.

- Immutability: Once a transaction is recorded on the blockchain, it cannot be altered. This ensures that the transaction history remains permanent and tamper-proof.

- Bitcoin (BTC): Launched in 2009, Bitcoin is the first and most well-known cryptocurrency. It’s often referred to as digital gold due to its value and limited supply.

- Ethereum (ETH): Known for its smart contract functionality, Ethereum allows developers to create decentralized applications (dApps). It’s the second-largest cryptocurrency by market capitalization.

- Ripple (XRP): Ripple focuses on facilitating real-time cross-border payments. Banks and financial institutions commonly use it for efficient currency transfers.

- Litecoin (LTC): Created as a faster alternative to Bitcoin, Litecoin processes transactions more quickly and has a higher supply limit.

- Cardano (ADA): Cardano offers a research-driven approach to blockchain, aiming for scalability, security, and sustainability in its design.

Blockchain vs. Cryptocurrency: The Key Differences

Blockchain and cryptocurrency, though closely linked, differ in core functionality, use cases, and security features.

Core Functionality

Blockchain serves as a decentralized ledger that records transactions across a network in an immutable and transparent manner. This technology underpins various applications beyond digital currencies, such as supply chain management and smart contracts.

Cryptocurrency, by contrast, operates as a digital asset designed to function as a medium of exchange, leveraging blockchain technology to ensure secure and transparent transactions.

Use Cases

Blockchain’s use cases extend into numerous industries. It’s pivotal in supply chains to track goods, in finance to facilitate secure transactions, and in healthcare to manage patient data. Blockchain’s versatility boosts efficiency in data management and transaction validity across sectors. On the other hand, cryptocurrencies primarily focus on financial transactions.

Cryptocurrencies like Bitcoin function as digital cash, while others like Ethereum support decentralized applications or smart contracts. Speculative trading and investment are prominent uses, driven by their value volatility.

Security Features

Blockchain ensures data integrity through cryptographic techniques. Each block links to the one before it, creating a chain that’s tamper-proof unless significant computing power is employed, which is costly and impractical.

Blockchain’s distributed nature means data isn’t stored in a single location, vastly increasing security against cyber-attacks. Cryptocurrencies inherit these security advantages, leveraging blockchain to secure transactions. Cryptographic methods ensure transaction data remain private while also affirming the authenticity and immutability of each transaction.

How Blockchain Powers Cryptocurrency

Blockchain provides the foundation for cryptocurrencies. It ensures secure, transparent, and decentralized transactions.

The Role of Blockchain in Cryptocurrency Transactions

Blockchain acts as a public ledger for cryptocurrency transactions. Each transaction gets recorded in a block. Blocks form a chain through cryptographic hashes, making tamper-proof records. Every participant (node) verifies and validates transactions, ensuring consensus.

This process prevents double-spending, a common issue in traditional digital transactions. By decentralizing record-keeping, blockchain eliminates the need for intermediaries like banks.

Benefits of Blockchain for Cryptocurrencies

Blockchain offers significant advantages to cryptocurrencies.

- First, it enhances security. Cryptographic principles ensure data integrity and protect against fraud.

- Second, it provides transparency. Every transaction remains visible to network participants, fostering trust.

- Third, blockchain ensures decentralization. Eliminating central control reduces the risk of corruption and system failure.

- Finally, blockchain guarantees immutability. Once data gets recorded, altering it becomes practically impossible, safeguarding transaction history.

Future Trends and Developments

Examining future trends in blockchain and cryptocurrency, it’s evident that both fields are set to evolve significantly.

Innovations in Blockchain Technology

Blockchain technology continues to advance rapidly. Enhanced consensus algorithms, like Proof of Stake (PoS), are becoming more popular. PoS offers energy efficiency and scalability compared to Proof of Work (PoW).

Interoperability between different blockchains is another key development. Projects like Polkadot and Cosmos aim to connect isolated blockchains, allowing them to communicate and share data seamlessly.

Smart contracts, powered by platforms like Ethereum and Cardano, are expanding in functionality. They enable complex, programmable transactions, fostering innovation in decentralized finance (DeFi) applications.

Emerging Cryptocurrencies and Their Impact

New cryptocurrencies are emerging, each offering unique features and improvements. For example, Solana promises high throughput and low transaction costs due to its novel Proof of History (PoH) consensus mechanism.

Stablecoins, such as USDT and USDC, are gaining traction by providing price stability, making them suitable for day-to-day transactions. These coins are typically pegged to stable assets, like the US dollar, reducing volatility common in other cryptocurrencies.

Privacy-focused cryptocurrencies, like Monero and Zcash, offer enhanced transaction anonymity. They employ advanced cryptographic techniques to conceal user identities and transaction details, catering to users prioritizing privacy.

Founder & CEO

Daniel Anderson is the visionary founder and CEO of the website, leading the charge in revolutionizing the crypto space. With a deep understanding of blockchain technology and years of experience in the industry, Daniel has established himself as a key figure in the cryptocurrency world. His passion for decentralization and financial innovation drives the platform’s mission to deliver cutting-edge insights and resources for crypto enthusiasts, traders, and investors. Under his leadership, the website has grown into a trusted hub for the latest trends, news, and developments in the digital asset space.

Founder & CEO

Daniel Anderson is the visionary founder and CEO of the website, leading the charge in revolutionizing the crypto space. With a deep understanding of blockchain technology and years of experience in the industry, Daniel has established himself as a key figure in the cryptocurrency world. His passion for decentralization and financial innovation drives the platform’s mission to deliver cutting-edge insights and resources for crypto enthusiasts, traders, and investors. Under his leadership, the website has grown into a trusted hub for the latest trends, news, and developments in the digital asset space.